All blog posts

Profit With AI is an educational and technology-focused blog created to help individuals understand and use modern digital tools to build smart online income systems. This blog primarily covers AI automation, emerging technology, SaaS platforms, online earning methods, and digital marketing strategies designed for beginners as well as intermediate users. The goal of Profit With AI is to explain how artificial intelligence and automation can be applied in real-world online businesses, content creation, freelancing, blogging, and marketing workflows to save time and increase productivity. We publish in-depth guides, tool comparisons, tutorials, and practical case-based content that helps readers make informed decisions instead of following unrealistic “get rich quick” ideas. Along with AI and tech insights, the blog also focuses on ethical online earning models, SEO fundamentals, website monetization, affiliate marketing, SaaS reviews, and digital growth strategies that are sustainable and compliant with platform policies. Profit With AI is built to provide clear, honest, and actionable information for anyone looking to grow skills, income, and digital presence in today’s AI-driven world.

Stripe India Account Setup & Payment Acceptance Guide (2026 Complete Guide)

February 5, 2026 | by mk75089317@gmail.com

Payoneer Se Paise Receive Kaise Kare Freelancing Ke Liye – Complete Step-by-Step Guide (2026)

February 1, 2026 | by mk75089317@gmail.com

Upwork Freelancing Kaise Start Kare India Se – Complete Beginner Guide (2026)

January 31, 2026 | by mk75089317@gmail.com

PayPal India Me Kaam Kaise Karta Hai? Wise Se Paise Transfer Kaise Kare India Se USA?

January 30, 2026 | by mk75089317@gmail.com

From Idea to Income: Starting an AI Automation Agency in 2026

January 25, 2026 | by mk75089317@gmail.com

Start Freelancing in 2026 with Zero Experience: The #1 Beginner’s Blueprint

January 24, 2026 | by mk75089317@gmail.com

AI Automation Maintenance Side Hustle: How People Are Making Monthly Retainer Income Without Building New Projects

January 23, 2026 | by mk75089317@gmail.com

One Person AI Business Models: The 2026 Solo AI Automation Guide

January 22, 2026 | by mk75089317@gmail.com

AI Agents & Autonomous Automation Tools: The Complete Beginner’s Guide for 2026

January 21, 2026 | by mk75089317@gmail.com

How to Create & Sell AI-Generated Digital Products in 2026 (Beginner’s Guide)

January 20, 2026 | by mk75089317@gmail.com

Aaj ke digital time me Indian freelancers, startups, SaaS founders aur online business owners ke liye international payments accept karna bahut zaroori ho gaya hai. Jab global clients ki baat aati hai, to Stripe duniya ke sabse trusted payment gateways me se ek mana jata hai.

Lekin sabse bada question ye hota hai:

👉 “Kya Stripe India me available hai?”

👉 “Stripe India account setup kaise kare?”

Is Stripe India Account Setup & Payment Acceptance Guide me hum step-by-step samjhenge:

- Stripe India ka current status

- Account setup process

- Fees & charges

- Limitations

- Aur best Stripe alternatives in India

Table of Contents

Stripe India Explained: Indian Users Stripe Kyun Search Kar Rahe Hain?

Stripe ek global payment gateway hai jo Amazon, Google, Shopify jaise brands use karte hain. Stripe ki popularity ka reason hai:

- Smooth checkout experience

- International card support

- SaaS & subscription billing

- Powerful APIs

Indian users Stripe isliye search karte hain kyunki:

- Unhe international clients se payment leni hoti hai

- Foreign clients PayPal ke bajay Stripe prefer karte hain

- SaaS products ke liye Stripe best mana jata hai

Lekin Stripe Razorpay ya Paytm jaisa simple nahi hai, especially India ke liye.

What Is Stripe & How It Works

Stripe ek online payment processing platform hai jo businesses ko cards aur international payment methods ke through paise accept karne deta hai.

Stripe Kaise Kaam Karta Hai?

- Customer card se payment karta hai

- Stripe payment ko process karta hai

- Fraud & risk check hota hai

- Amount business ke bank account me settle hota hai

Stripe Ecosystem

- Stripe Payments – Card payments

- Stripe Checkout – Ready-made checkout pages

- Stripe Subscriptions – Recurring billing

- Stripe APIs – Custom payment systems

- Stripe Radar – Fraud prevention

Is Stripe Available in India? (Important Section)

Stripe India Ka Current Status

Stripe India me limited form me available hai. Matlab:

- Har Indian user Stripe account nahi bana sakta

- Individual freelancers ke liye kaafi restrictions hain

Kaun Stripe Use Kar Sakta Hai India Me?

✔ Registered export businesses

✔ SaaS companies

✔ Private Limited / LLP companies

✔ International clients ko services ya products sell karne wale businesses

Kaun Stripe Use Nahi Kar Sakta?

✘ Individual freelancers bina registration ke

✘ Sirf Indian customers ke liye kaam karne wale

✘ INR-only payment lene wale businesses

✘ Bina compliance documents ke users

⚠️ Disclaimer: Stripe approval RBI regulations aur Stripe ki internal compliance par depend karta hai.

Stripe India Account Setup – Step-by-Step Guide

Stripe India Account Ke Liye Required Documents

- Business PAN Card

- Certificate of Incorporation

- Business Address Proof

- Authorized Signatory ID

- Export-related details

- Indian Current Bank Account

Supported Business Types

- Private Limited Company

- LLP

- Export-based registered businesses

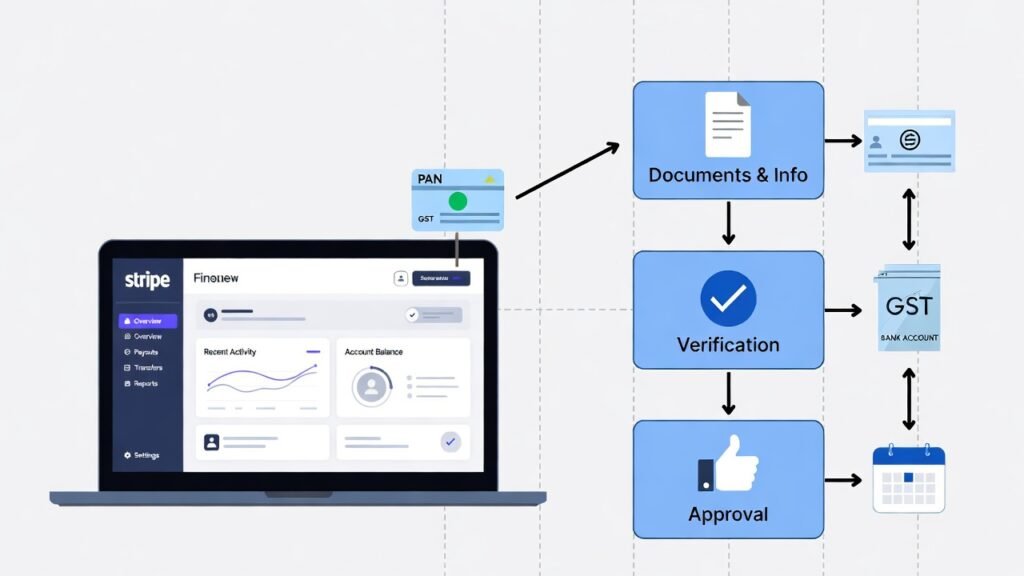

PAN, GST & Bank Account Requirements

- PAN: Mandatory

- GST: Zyada cases me required

- Bank Account: Indian current account

Verification Process

- Business details submit karna

- Documents upload karna

- Compliance & risk review

- Approval (1–3 weeks lag sakte hain)

How to Accept Payments Using Stripe in India

Stripe Me Kaunse Payments Accept Hote Hain?

- International credit & debit cards

- Visa, Mastercard, Amex

❌ UPI

❌ Net banking

❌ INR domestic payments

Supported Currencies

- USD

- EUR

- GBP

- Other major foreign currencies

Settlement Process

- Payment foreign currency me receive hoti hai

- Stripe INR me convert karta hai

- Indian bank account me payout

- Payout time: 5–10 working days

Stripe India Fees & Charges

Stripe Fees Breakdown

| Fee Type | Approx Cost |

|---|---|

| International Card Fee | ~2.9% + ₹3 |

| Currency Conversion | 2%–4% |

| Refund Fee | Non-refundable |

| Dispute Fee | Extra charges |

Hidden Charges Samjho

- FX markup

- Cross-border fee

- Chargeback handling fee

Stripe India Limitations & Common Problems

Major Limitations

- UPI support nahi

- Approval mushkil

- Individual freelancers ke liye not ideal

- RBI compliance issues

Common Problems

- Account rejection

- Payment hold

- Sudden review

- Delayed payouts

Best Stripe Alternatives in India

Agar Stripe aapke liye suitable nahi hai, to ye options better kaam karte hain:

Top Stripe Alternatives

| Platform | Best For | International Payments |

|---|---|---|

| Payoneer | Freelancers & exporters | Yes |

| PayPal | Freelancers | Yes |

| Razorpay | Indian businesses | Limited |

| Wise | Low-fee transfers | Yes |

Stripe vs PayPal vs Razorpay

| Feature | Stripe | PayPal | Razorpay |

|---|---|---|---|

| International Cards | Yes | Yes | Limited |

| UPI Support | No | No | Yes |

| Approval Process | Hard | Medium | Easy |

| SaaS Billing | Excellent | Basic | Limited |

- Processor: 12th Gen Intel Core i3-12450H | Speed: 8C (2P + 4E) / 12T, P-core 2.0 / 4.4GHz, E-core 1.5 / 3.3GHz, 12MB Cac…

- Display: 15.6″ FHD (1920×1080) | TN | 250nits Brigthness | Anti-glare

- OS and Software: Windows 11 Home 64 | Office Home 2024 | Xbox GamePass Ultimate 3-month subscription

Is Stripe Worth It for Indian Businesses?

Pros

✔ Global trust

✔ Best for SaaS & subscriptions

✔ Powerful integrations

Cons

✘ Hard approval

✘ Beginners ke liye complex

✘ No UPI or INR support

Best Use Cases

- SaaS startups

- Export service providers

- US / EU clients wale businesses

Stripe India FAQs (SEO Booster Section)

Q1: Kya Indians Stripe account bana sakte hain?

Haan, lekin sirf eligible registered export businesses.

Q2: Kya Stripe India me UPI support karta hai?

Nahi, Stripe UPI support nahi karta.

Q3: Stripe payout India me kitna time leta hai?

Usually 5–10 business days.

Q4: Kya GST mandatory hai Stripe ke liye?

Most cases me haan.

Q5: Kya freelancer bina company Stripe use kar sakta hai?

Generally nahi.

Final Verdict: Kya Stripe India Me Use Karna Chahiye?

Agar aap:

✔ Registered business ho

✔ International clients ke saath kaam karte ho

✔ SaaS ya export services provide karte ho

to Stripe ek powerful option hai.

Lekin agar aap:

- Beginner ho

- Freelancer ho

- Simple international payments chahte ho

to Payoneer ya PayPal zyada practical choice rahegi.